According to Çağnur Cessur in a recent post on X, Polkadot (DOT) has been consistently trading within a clearly defined black channel on the monthly chart. This channel is formed by well-established horizontal support and resistance levels, which have been tested numerous times over the past 4 to 5 years. The range, spanning from $4 […] Сообщение Polkadot Price Caught In A 5-Year Channel – Can It Finally Break Free? появились сначала на КриптоВики.

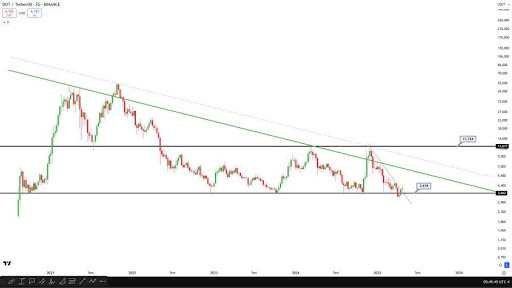

According to Çağnur Cessur in a recent post on X, Polkadot (DOT) has been consistently trading within a clearly defined black channel on the monthly chart. This channel is formed by well-established horizontal support and resistance levels, which have been tested numerous times over the past 4 to 5 years.

The range, spanning from $4 on the lower end to around $12 at the top, has effectively boxed in DOT’s price action, shaping a long-term sideways market structure. A clear move beyond this 5-year range, especially on strong volume, could mark the beginning of a new trend, either into price discovery or deeper support levels.

Cessur emphasized in his recent analysis that the green channel shown on the Polkadot chart represents a downtrend that has been in place for nearly four years. This trend has consistently guided the broader market structure, acting as a long-term resistance. However, he noted that if DOT manages to break above this channel, it could set the stage for a major trend reversal to new highs in the months ahead.

He also drew attention to DOT’s short-term outlook, where a red falling channel on the weekly timeframe has just been breached to the upside. According to Cessur, this development is a sign of potential bullish continuation, positioning DOT as one of the altcoins to start an increase.

The analyst concluded that if the asset continues to follow the multi-year pattern of ranging from $4 to $12, another climb toward the top of this range seems likely. Most importantly, if the weekly candle closes above $4.70, he noted that the chances of seeing a swift move toward $10 could increase significantly, supported by growing bullish momentum and historical price behavior.

The bear case for Polkadot revolves around the critical $4 support level, which has been pivotal in maintaining the altcoin’s price structure. If DOT loses the $4 mark, it might signal a deeper bearish move. This would invalidate recent bullish hopes and raise the potential for further declines as market sentiment shifts to a more risk-averse stance.

Such a drop would suggest that the upward momentum observed in recent months could be a false rally, with DOT’s price unable to maintain its position above key support levels. Its failure to hold above $4 may prompt heightened selling pressure, especially when broader market conditions worsen or there’s a loss of confidence in Polkadot’s long-term prospects.

Additionally, a move below this critical support would raise the probability of a retest of all-time lows, which would be a significant bearish development for the token. In this scenario, patience and strategic re-entry points would become key factors for short and long-term holders.

Сообщение Polkadot Price Caught In A 5-Year Channel – Can It Finally Break Free? появились сначала на КриптоВики.